There’s no question that a mortgage is a big investment. For most people, it is the largest investment you’ll ever make. It’s also the largest loan amount of money you’re likely to have in your life, which gets some people’s minds wandering.

It’s not totally uncommon for homeowners to want to put their mortgage or a portion of their mortgage toward something other than their house. Whether or not this is possible depends on where you are in the process.

The First Mortgage

When you first buy a home, you don’t technically own anything. Your lender puts up the money for the house, and aside from your down payment, you haven’t contributed anything toward the purchase price.

The person or organization that owned the house before you want to be paid for the property, which is why the mortgage amount must go toward paying them. If you buy a home for $300,000 and use $50,000 of that for something other than your mortgage, how will the previous homeowner be paid?

Of course, if you buy a home for $300,000 and secure a mortgage from your lender for $350,000, then you’ll have extra money to do other things. Keep in mind though, not every lender is flexible enough to do something like this, and you must have a very favorable credit score and financial situation in order to make it happen.

Second Mortgages

If you’re looking for a second mortgage, the parameters are a little different. Most of the time, these are called “home equity loans” because you are using the equity you’ve built up in your home as collateral.

Typically, people look for home equity loans several years into their original mortgage, because they’ve paid off the interest and a portion of the principal. If you fall into this category, then you can put your mortgage toward other things, as this is usually why they take out a second mortgage in the first place.

Reasons for a Second Mortgage

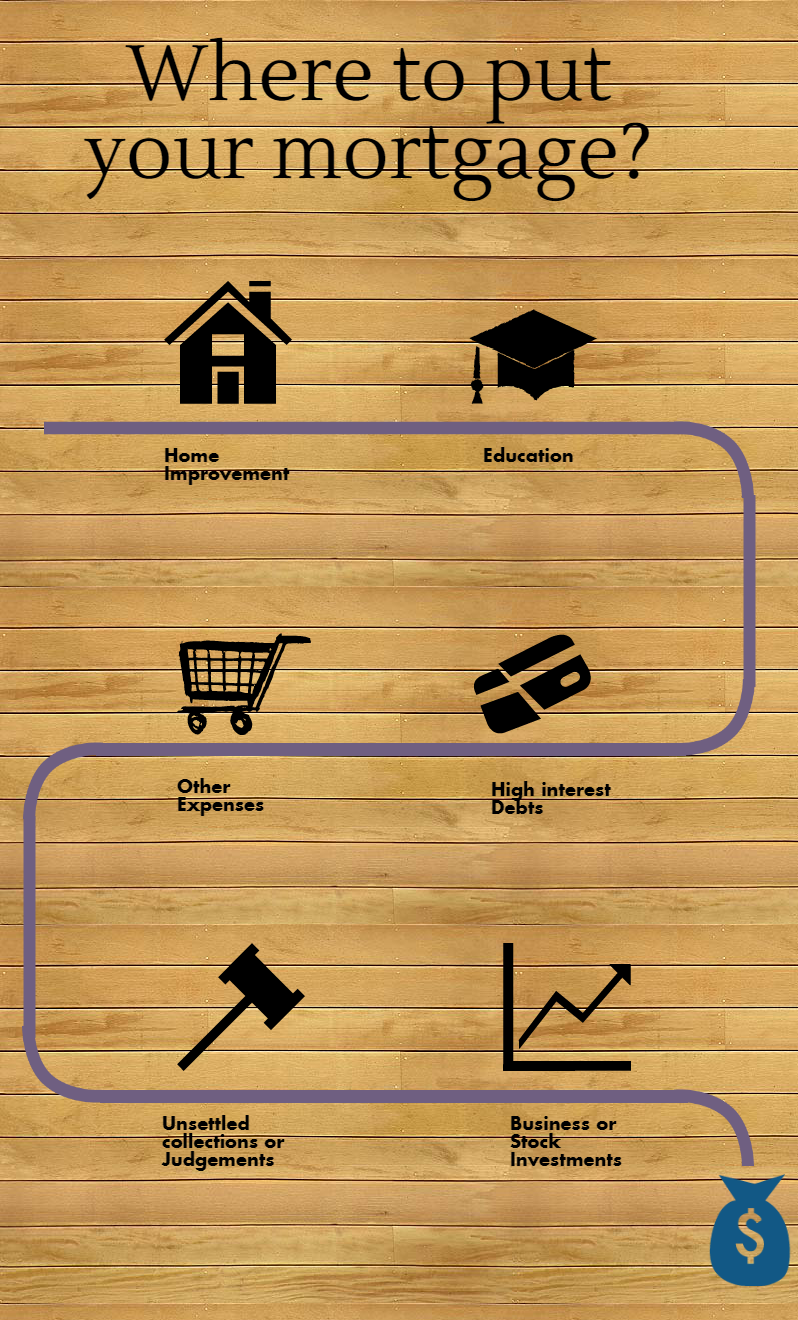

So, why would you want to take a second mortgage and free up some cash? There are scores of common reasons homeowners look in this direction. Here are some of the most popular:

· Home renovations

· Paying for kids’ schooling

· Pay for unexpected expenses

· Consolidate other high interest debts

· Eliminate unsettled collections or judgments

· Business or stock investments

The list goes on, but it’s important to realize a second mortgage doesn’t replace the original one, and in a case of loan default, the first mortgage will be paid off first. Unlike a first mortgage, the equity in your home is the primary factor when seeking a second mortgage. Your credit score and income usually take a back seat because you actually have something of value to put up against the loan.

Whatever part of the process you are in, make sure you weight all the pros and cons before you take any action, especially when it comes to taking on more debt. Even if you have the equity in your home, you still owe the money so only take it if it’s absolutely necessary.

Author Bio:

I am Eric Jones, a businessman by profession. Business and entrepreneurship are my passion and I love researching on the various aspects of those areas. I make sure that I don’t miss out any updates and for this reason I read quite a lot. Law is yet another area which I am passionate to know more about.