For shoppers, the catalogue credit line offers an easy and convenient way to buy products based on a specific payment plan. In the following article, we’ll be discussing about the how catalogues for bad credit are helpful for your shopping. Before that, let’s see what exactly the catalogue credit limit is.

An Introduction to Catalog Credit Line

Basically, the catalogue credit line is quite similar to the credit card account. You can get your line of credit extended, and then purchase the products from a catalogue by paying just the minimum amount as up front fees.

There are a few ordinary catalogues that offer instalment plans, wherein you need to make the payments either on a weekly or monthly basis. There are some others that offer extensive cyclic line of credit, enabling you to buy multiple items and keep paying off the minimum instalments until the total balance is paid off.

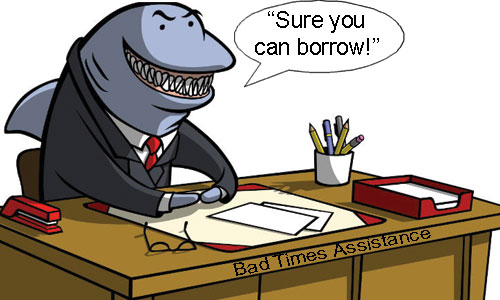

These catalogues offer a certain credit line or limit up to which the customers can purchase any merchandize that they want. The majority of shoppers prefer applying for the credit lines with such catalogues, rather than applying for the credit cards because of their past credit issues.

Customers with poor credit rating find it difficult to apply and get approved conventional credit cards. This is where these speciality catalogues for bad credit customers help you a lot. In addition to giving you credit for shopping, they also extend your credit line if your purchase is a bit larger.

However, you can’t just use any credit line for all the catalogues. You need to use your catalogue credit lines only with that specific catalogue, which issued it for you. Like the conventional credit cards, you can extend your credit amount, but the process depends on the service provider. It also depends on

Interest

The interest rates for the credit line normally vary with the rules, regulations, terms and conditions of a catalogue. Some catalogues also offer interest-free instalments on the purchases, while some others tend to charge specific amount as interest on the outstanding balances.

Always read the rules and regulations of the catalogue credit line to know whether or not you’ll be charged specific fees or interest rates. Be warned that the credit line is different from the credit card, and thus the repayment rules and interest charged are different.

Applying for Credit Card Line

Before you actually apply for the catalogue credit line, you’d need to understand what you are opting for and its purpose. Make sure your credit line allows you shop around with diverse stores. Getting a line of credit that is exclusively available to one catalogue would not help you in the long run, as you can’t use it for purchasing with other stores.

Applying for the credit line is now much easier with the catalogue websites. All you have to do is look for a reliable catalogue, and buy what you want. Any reputed website will have excellent customer support, be online or telephonic. Before you finalize the catalogue you want to go with, make sure you find out whether your credit account activities will be reported to any of the credit reporting agencies.

Author’s Bio:

Stephen Tomalin has written many articles about how you can manage monthly repayments and outstanding loans with the help of catalogues for bad credit. For info on improving your credit history, kindly visit their website.