Are you in need of a personal loan? You will find that you have many options in the market. It is important to assess your options carefully before signing up for anything. After all, you would not want to get yourself stuck with a loan that is more than you can handle and ruin a long history of good credit.

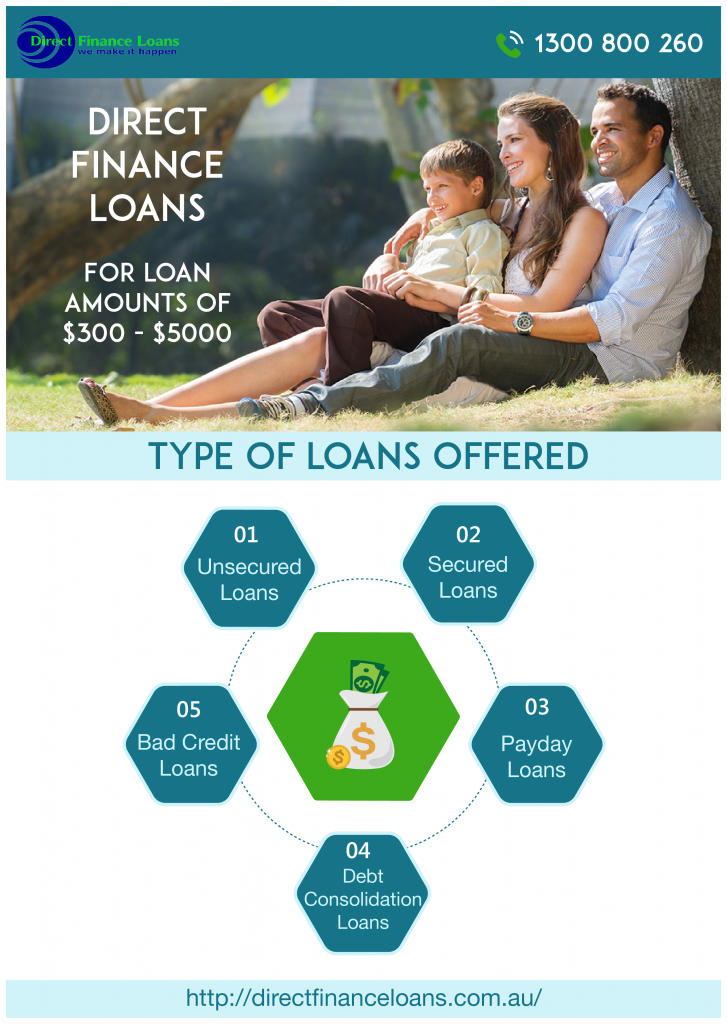

One kind of loan that you can obtain from a reputable lender like “Direct Finance Loans” is an unsecured personal loan. What are the advantages of getting such a loan and how is it different from other types of loans in the market? These are all perfectly good questions and a few things that you would do well to consider before applying for an unsecured personal loan.

What you need to know about getting an unsecured personal loan

As the term may already suggest, unsecured personal loans do not require a collateral of any kind, unlike conventional ones that require a lien on your vehicle, home or anything of value that you possess. Hence you can have peace of mind knowing that you are not putting your possessions on the line just to get a loan approved. People in desperate need of a loan are often hesitant to get one if it means losing their home if they miss a payment or two. With an unsecured loan, people need not worry about putting themselves in such a vulnerable position. You might be wondering though – if an unsecured loan is almost always the better deal, why do we not see it often in the lending industry?

Now the truth is that not too many lenders out there offer unsecured loans. Of course, getting an unsecured personal loan has its challenges, and the application process is often more complicated compared to that of a secured loan. Requirements are much more stringent, and only people with a good credit rating can ever hope to get approved for an unsecured loan. If you have a history of bad credit, lending firms are almost always guaranteed to refuse an unsecured loan. If that sounds a lot like you, then you best consider other options such as a bad credit loan and rebuild your credit rating. Only then can you expect to qualify for an unsecured loan.

Another challenge that comes with obtaining an unsecured personal loan is that lenders often charge bigger interest rates due to the greater risk involved. Also, the loan amount is somewhat limited and hardly enough to finance a new car or a home.Still, if you must get a loan that does not require putting any of your assets on the line, then an unsecured personal loan might just be the answer!

Learn more about getting an unsecured personal loan by checking out reputable sources of information on the web similar to what you would find at http://directfinanceloans.com.au/ . The more you know about such a loan, the less likely you will end up running into dire financial problems as a result of the credit.