Looking to make an informed decision on which financial institution best suits your needs? You will needs to explore the differences between a Credit Union and the larger intuitions known as the Big Banks. Here we will looks at how the two compare, differ, and the pros and cons associated with each.

Credit Unions offer many similar features to their Big Bank counterparts. Clients (known as shareholders) can open accounts, deposit and withdraw funds, and secure credit cards, loans, and mortgages but operations are handled in subtle yet significant ways.

Looking to make an informed decision on which financial institution best suits your needs? You will needs to explore the differences between a Credit Union and the larger intuitions known as the Big Banks. Here we will looks at how the two compare, differ, and the pros and cons associated with each.

Credit Unions offer many similar features to their Big Bank counterparts. Clients (known as shareholders) can open accounts, deposit and withdraw funds, and secure credit cards, loans, and mortgages but operations are handled in subtle yet significant ways.

An important difference to note is status. Big Banks are profitable organizations, where credit unions are non-profit and thus tax exempt financial institutions. A second key difference is credit unions are member-focused cooperatives that are owned and operated by members known as shareholders; they aren’t run by a panel of stockholders interested in only the welfare of the bank and not the customer. Once you open an account, and make your first deposit, you are considered a member. Some credit unions have limitations on who can become a member (where the big banks take anyone!). For example, some may be profession exclusive (Teachers, Dentists, etc.) while others only grant new applications to family members, spouses, children, or other connections vouches for by a current member in good standing. Other credit unions offer membership to local community members.

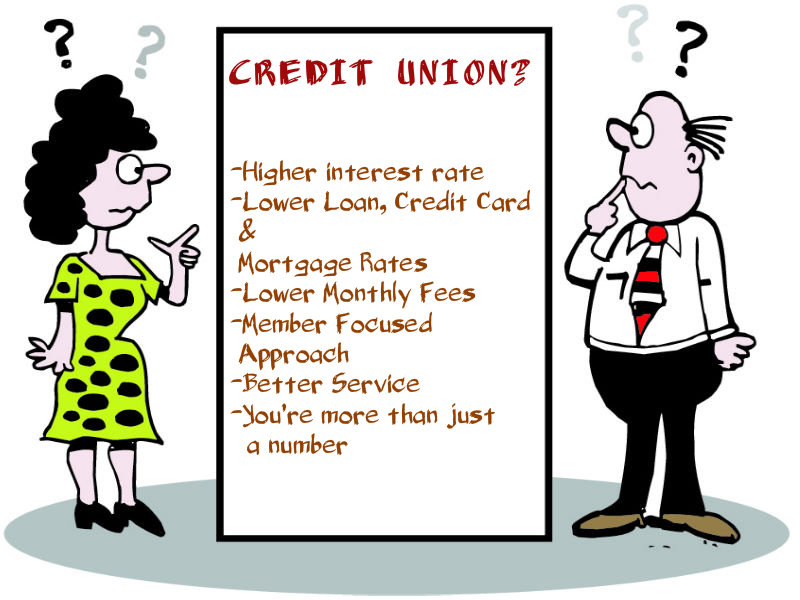

Credit Union vs Big banks—why Credit Unions are the better bet:

-

Higher Interest Rates: did you know that you can make 4 to 10 times more interest on your money when deposited in credit union accounts? This is because they are non-profit, tax-exempt and have less payout to upper management and more focus on their members.

-

Lower Loan, Credit Card, & Mortgage Rates: Credit unions offer many of the same services and products as the big banks, but at a reduced rate. Again less funding goes to stockholders, and more to shareholders!

-

Lower Monthly Fees: Big banks offer convenience at a price! They tag monthly accounts with hefty fees, charge day to day debit transactions, penalize you for using an ATM outside your institution, and have high rates of loans and credit cards when interest accrues. Credit Unions offer reduced (sometimes no) fee chequing and savings accounts, unlimited transactions, and even offer reimbursement when using ATMs belonging to other banks as they don’t have the number of freestanding quick-cash machines that others do. You will still pay for overdraft and bounced cheques, but often the fee is substantially less (~$10)

-

Member Focused Approach: Credit unions are in place to service the individuals and not board of directors and upper management. Big banks set rates and make moves to increase profit margin where credit unions aim to keep rates low, and work for the customer, not make the customer work for them! This results in…

-

Better Service: Smaller membership and smaller branches means a personalized approach, often on a first name basis. Annie B. reports “When I got married my husband encouraged me to open an account at his credit union, boasting of wonderful customer service, a stake in the shares, a warm cup of coffee on every visit, and a smile and by-name greeting every time he walked through the door. On my second visit, they knew me by name and even asked about our honeymoon! They made our mortgage application comfortable and took a chance on us even though we were a young couple and first time home-buyers. I would recommend the use of a credit union to anyone looking for a better experience with banking!” You can look forward to shorter lines, faster service, and a friendly face each time you visit your branch. Bigger banks have longer wait times, rarely recognize you, and have no use for personal stories! They want you in and out on their terms!

-

You’re more than just a number! Credit unions have greater flexibility when making decisions on mortgages, loans, and credit card applications as they see your paperwork as a name and face whereas larger banks process high volumes where you’re known by your application number. Credit unions have the ability to work around blemished credit history, low income, and other complications and strive to help you get achieve the desired end result. They also offer personal counselling to help get you on track or make wise decisions about large purchase such as your first home!

Author bio:

Lori J Sanders was born and raised in Toronto. She has been a proponent of business education, investing, a self-help author and a motivational speaker. She operates on her own blog and she speaks up on whatever that comes to her mind about finance, investment, mortgage renewals. With various real-estate investments, she retired at the age of 46. But she still continues to operate external business ventures and various investments. For more information, follow her on twitter.