High risk auto loan lenders are increasing as a percentage of loan lenders online. As more people find themselves out of work or in need of medical assistance, many times the only asset that they have to turn to is their car title.

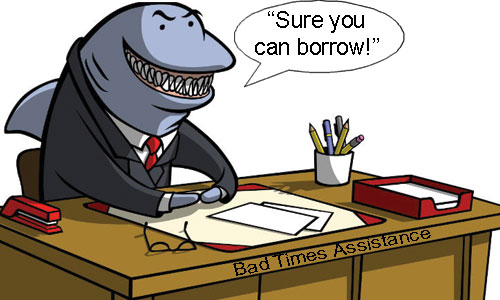

Although there are legitimate ways of leveraging your car title in order to get short-term loans for unexpected emergencies, there are also some pitfalls to avoid. Make sure you follow the tips below so that you can keep away from the sharks that are online.

Tip 1 – Make sure that any company you do business with has a written agreement. Make sure that you read this agreement before you sign it.

When it comes to loan lenders online, there is not a great deal of active regulation. The Better Business Bureau does keep records of financial companies online, and you should go through their records before entrusting your financial information to anyone, first of all.

The financial regulations that came about under the Obama administration after the 2008 banking crisis did not affect the high risk auto loan lenders industry. Keep in mind that you do not have the recourse of the legal system and pay attention to what you are signing.

Tip 2 – Make sure that any company that you do business with has been doing business for a while.

With online resources, it is easy to check the past history of any business. Be sure that any company that you are getting an auto loan from has been doing this type of business for some time.

As stated before, you can check the records of the Better Business Bureau if you cannot find a company using the major search engines. Most high risk auto loan lenders will not have any listings in the major search engines. Many loan lenders online who do not have an established name in the industry will work under many different names. This is a red flag for you as a borrower.

In order to avoid companies who do not have a solid reputation, take note of webpage templates that look the same. Many companies will put up the same webpage under different URLs to catch people who are looking for different keywords. Any company that cannot at least invest in an original website does not deserve your business.

Tip 3 – Pay attention to offers that are too good to be true.

You should know the going market rate for short-term loans so that if you come across a company that is advertising a rate much lower than this, you can give them more scrutiny. Do not be fooled by low interest rates. These may simply be a trick to get you to sign a contract that will immediately place you under untenable conditions.

High risk auto loan lenders love to jack up interest rates in the fine print of a contract. In many cases, if you miss a single payment, you can be held accountable for interest rates that triple overnight. Keep in mind that there is very little federal regulation over this type of financial dealing, and even if you have the law on your side, you need a great deal of money in order to defend your position in a court of law.

High risk auto loan lenders and all loan lenders online without a solid reputation are relying on your ignorance in order to succeed. With just a little bit of research, the false nature of these companies can easily be brought to the surface. Perform your due diligence before you give your financial information to any company.