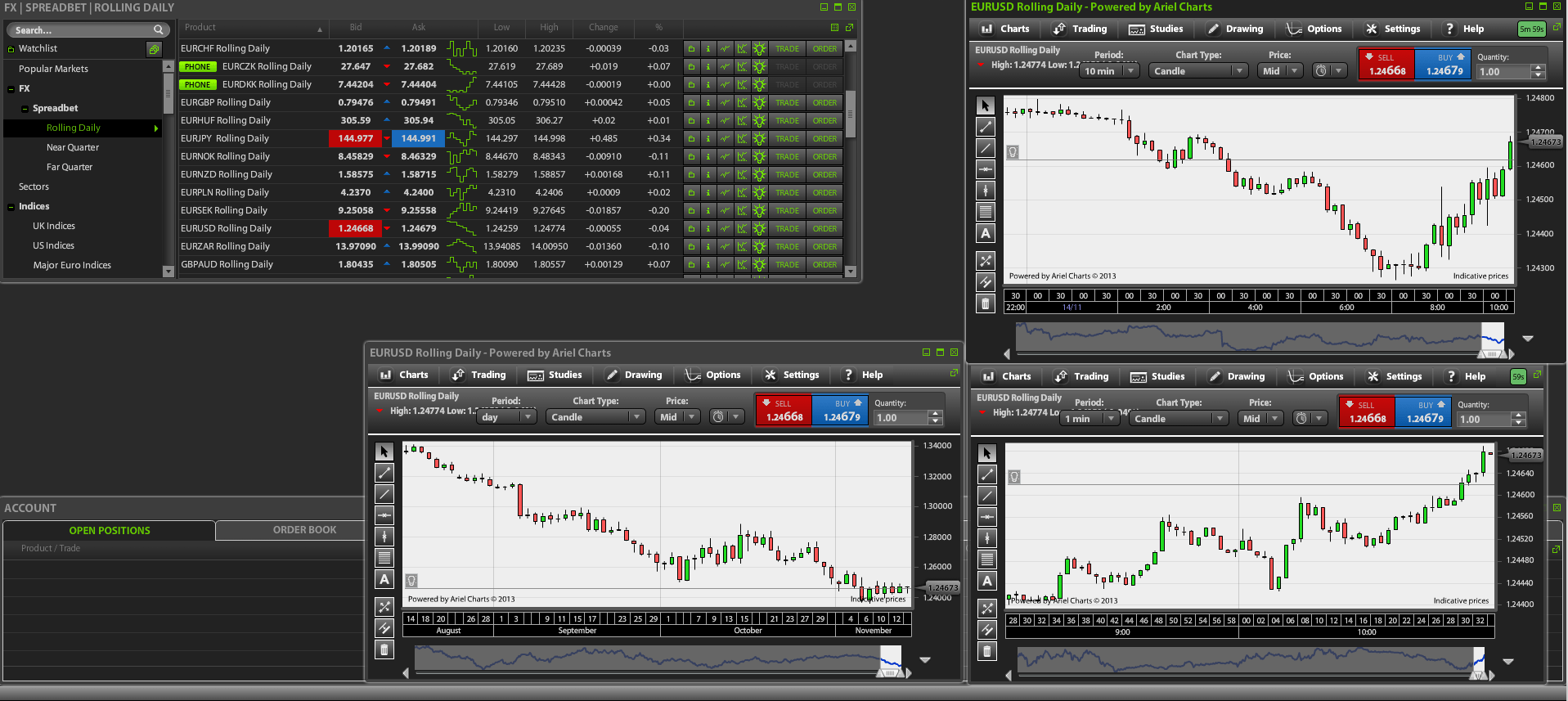

There are many hidden dangers of online trading with Trader Pro Platform even though it may seem like a fairly quick and convenient way to build wealth on the outside. The ease of making trades and raking in profits deceives most people and this is the main risk associated with using the Trader Pro Platform. Otherwise conservative investors may trade too frequently seeing the lower costs and higher speeds of online trading. This may lead to them selling their best pick when it’s just getting started.

While the rewards of online trading using Trader Pro Platform outweigh the risks associated with it, it is important that you make decisions that help you to mitigate your risk. ETX Capital and many other brokers also ask users of Trader Pro Platform to be wary of these Risks and plan accordingly.

Demo Accounts Can Breed False Confidence

Some users start off by using the “demo accounts” as they are nervous about trading stocks online using live accounts. Apart from the fact that you can’t buy stocks in them, Demo accounts are identical to real accounts. These demo accounts provide traders a free opportunity to learn online trading without losing any money. You can learn online trading essentials, such as how to enter an order to sell or buy stocks; how to double-check your order before submitting it by using an online broker’s practice account. This helps you to avoid obvious but common mistakes.

However, there is a risk attached to demo accounts and that risk is breeding of false confidence. Many a times, traders that do well on demo accounts will try out a risky and ultimately unwinnable investment approach. This often delivers losses instead of profits.

Automated Stock-picking Systems May Backfire

In order to help them make investment decisions, some online traders use automated stock-picking systems. Impressive-looking performance records marketing these systems often fool investors into thinking that they will make a guaranteed profit. However, “back-testing” the program against past data typically derives these records.

In simple words, these records show old trading records that worked in the past. Basically, automated stock-picking systems narrow down the data you use when you make investment decisions and apply a fixed rule to draw an investment decision from that selection of data. Unfortunately, continually changing are market’s key concerns. Today’s good investments can turn into tomorrow’s dead ends.

Late Night Blues

Online trading platforms like Trader Pro allow traders to trade even after the stock market closes on a particular day. This often lures traders to trade. Using electronic communications networks (ECNs), traders perform transactions. Price volatility, reduced ability to act upon current quotes and more competition with professional traders are just some of the drawbacks of trading in the wee hours of the night.

While there are many rewards of using Trader Pro Platform, there are also some risks associated with it. These are risk ETX Capital and other brokers advise their users to be wary of as it can save them from substantial losses.