The term Refinancing refers to the replacement of an existing loan with a new loan under different terms. Terms and conditions for refinancing differ from countries, state, and provision. It is also based on several economic factors such as projected risk, currency stability, borrower’s credit worthiness, inherent risk, project’s risk and political stability of the country. One of the types of refinancing is mortgage refinancing. The refinance mortgage Toronto helps in reducing stress that arises while payment of a monthly premium. They are available at various purchasing prices. Time also plays a vital role as the lenders offer some discount and special offer to their customers sometimes. Different schemes that are offered by the organization of mortgage refinancing gives benefit to the borrower. It also depends upon you from whom you are purchasing the refinancing scheme. Refinancing is done in cases where one finds that the rates of the interest are rising, or they have become bankrupt. Even if you have become bankrupt, some organization will help you in doing refinancing.

Reasons to go for Refinancing Mortgage

Benefits Borrower with Low Interest Rates

Save yourself from penalties by breaking your contract for lower interest rates. Saving money also depends on the penalty and size of the mortgage. If you buy a variable rate mortgage, then you are expected to pay a penalty for three months. Moreover, if you buy fixed rate mortgage, then you have to pay greater of three months.

Access Equity in your Home

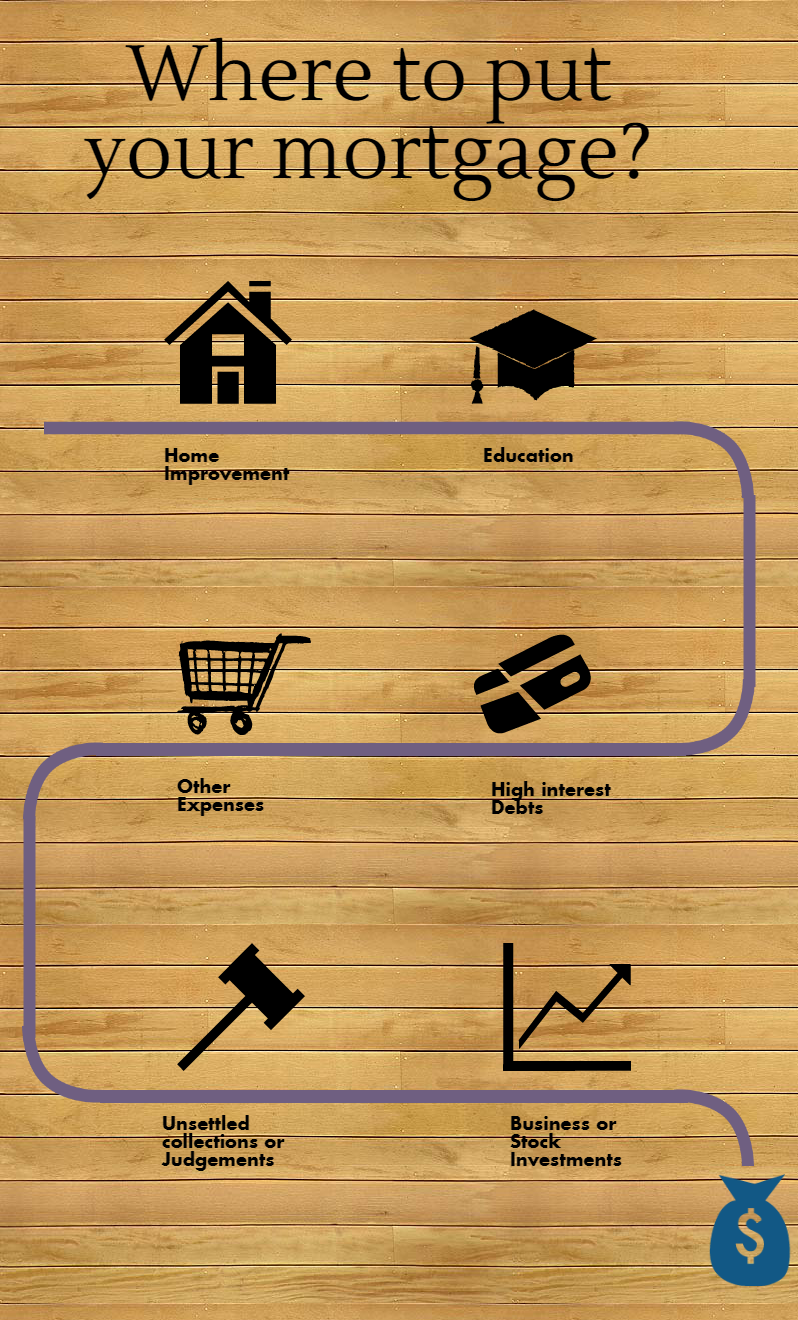

By refinancing, one can across up to 80 % of their home’s value. The money that you save can be used for different investment, children’s education or home renovations. You have several options to access the equity that includes taking on a home equity line of credit, breaking your mortgage or extend your mortgage with current lender or organization.

Consolidate Debt

If you have enough money with you, then you can pay high-interest debt through refinancing. You can consolidate all your debt such as car loans, credit card bills or a line credit through a variety of refinancing options that are available.

You should take help from experts that have knowledge related to mortgage. There are loan agents who would be of your great help in refinancing. You should be careful while selecting the mortgage plan as it affects your financial condition. One mistake can result in worse financial condition. Choose a plan that perfectly suits your monthly expenses. For a low premium per month, you can extend the time of the mortgage. The refinance mortgage toronto gives you the option of extending the period for payment of the loan. It will reduce the amount you pay per month, and you can save money. It is better to investigate the organization you are planning to do refinancing. Check out their past records and ensure they do not cheat you with anything. Your investigation will also help you as you will gain information related to refinancing, and you can select the best plan.

The cost of refinancing depends on the strategy you choose. Few lenders charge a penalty if one breaks the mortgagee in the middle. There are different quotes for mortgage available online. You can also apply online for refinancing. The method is easy and simple. You just have to fill the form that can be done quickly. However, it is advised that you apply for a mortgage only from trusted parties. To avoid the risk that arises in a mortgage take amount that you need. Rather than taking fewer amounts than getting in trouble, take a little more amount to be on the safer side. More on http://esscnyc.com/.