Moving away to university is an exciting time. But, you need to have a savvy approach to money to ensure that you don’t fall into any financial problems while you are away from home. After all, if this is your first journey into total independence, getting the balance right can be difficult. There are heaps of ways that you can ensure that you are productively managing your finances while you embark on this journey into adulthood. It doesn’t have to be a difficult process. But, applying some common sense tactics to your finances can be a great way of making sure that you don’t have any cash flow problems during this time.

With this in mind, it’s time to see how you can have a great time at university, without breaking your bank balance in the process.

Budgeting Your Money

One of the smartest things that you can do when you are away at university is to budget your cash. While the thought of having to forgo certain luxuries can be disheartening, it’s vital that you do this in order to preserve the limited cash flow that you have. When it comes to matters regarding money, you need to make sure that you are compiling an effective income and expenditure. Factor in your living costs and your bills. Setting up a spreadsheet or making a few doodles on a notepad can make sure that you are assessing your finances in a more realistic way. Once you have totted up how much that you have to spend on living costs, you can then figure out how much you have in disposable income. When it comes to student life, you don’t have to spend a great deal of money to enjoy yourself. After all, your new friends at university will be in the same boat as you i.e. you’re all skint. This means that you will have to be inventive with pursuits and hobbies. You will find that these are the best years of your life and that you don’t need a great deal of money to have fun.

So, compile an effective budget and have a blast during your student years.

Seek Financial Assistance

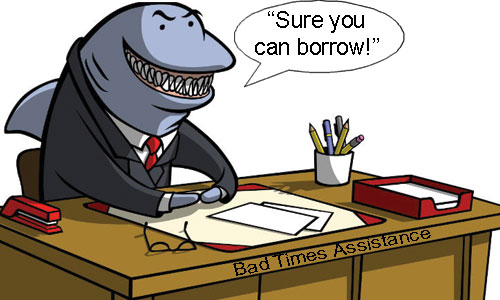

Financial assistance comes in many different forms when you are at university. There are grants, loans, bursaries and assisted living costs. So, if you are keen to make sure that your cash flow doesn’t dwindle, now is the time to look at what financial assistance is available to you.

When it comes to loans and overdrafts, it may be wise to consider alternative options. These, alongside credit cards, are costly ways of living, so you want to avoid them where necessary. Of course, avoiding credit altogether can have a bigger impact in the figure. You need to have some credit history. But, the key is to creature a delicate balance of having manageable debt. Of course, if you are finding that you are spending more than you mean to, you need to finds ways of getting out of debt. This can come into the forms of consolidation or rethinking your budget strategies. Debt management and money matters are one of the toughest life lessons that you will learn while you are a student. But, it certainly does prepare you for the wider world once you leave the bosom of halls.

Living Within Your Means

Okay, so now is the time to make sure that you are living within your means. Of course, in some circumstances credit is unavoidable. You have to have a means of living and sometimes credit, in the form of credit cards and loans are the only way to survive while you are at university. With this in mind, you need to make sure that you are not spending more than you earn every month. It all comes down to successful budgeting. Alongside your carefully planned and well thought out budget, you need to attempt to make sure that you are not spending more than you earn on a regular basis.

When it comes to the new semester, the price of books and equipment can leave you short of more than a few pounds. This is the best time to take out a credit card, if you absolutely have to. Ensure that you are only buying necessities. Obviously, course materials form part of an essential when you are living within the confines of a university. The key is to make sure that these loans are paid back in a timely manner in full. This builds your credit rating, but also makes sure that you are not blowing the budget unnecessarily.

Taking Proactive Steps to Manage Debts

If you have gone to university with prior debts, you may find this an unsettling time financially. Some new students have worked prior to their full time studies and as such may have accumulated debts during this period. Now is the time to manage your debts in a more steadfast way.

Make sure that you are compiling a list of creditors, their interest rates and the amount that you pay on a monthly basis. If you are making the minimum payments, this is a great place to start. But, you need to be aware that this will incur those loathed high rates of interest.

It may be time to take more proactive measures when it comes to overseeing your debts. This may mean seeking financial advice and talking to your creditors. In some circumstances, your creditors may lower the rate that you pay back the finance or they may extend the term time to ensure that you don’t meet difficulties. It goes without saying that creditors are interested in getting their money back with little expense to them.

However, this can be difficult and some creditors may not be as lenient as others. With this in mind, you need to find alternative ways. Consolidating your existing debt for the duration of your studies is a great way to slash interest rates and make sure that you are keeping your credit score at a healthy rate. Think about your options and how you can take proactive steps to effectively handle your debt while you stuffy.